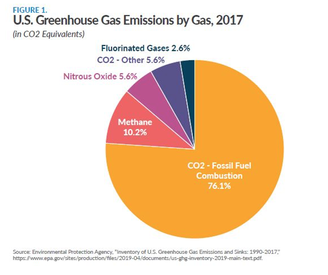

Photo by Sam Jotham Sutharson on Unsplash Photo by Sam Jotham Sutharson on Unsplash The fact that human-induced emissions have largely contributed to climate change, is overwhelmingly endorsed by researchers and scientists. This has led countries to introduce and implement stringent environmental regulations and taxes. The ever-present emissions of greenhouse gases are expanding planetary temperature graphs, thawing glaciers and permafrost, changing atmospheric circulations and precipitation patterns, increasing sea-levels, washing out coral reefs, and affecting flora and fauna biodiversity in terrestrial as well as aquatic ecosystems. These changes in environmental processes are responsible for the collateral damage of the infrastructure, the agricultural productivity, and the economy. However, these socio-economic costs are not considered in the prices for energy commodities. Thus, legislations like the carbon dividend act are the blueprint to mitigate the looming climate crisis. Carbon pricing provides strong market incentives for emission reductions and alternative energy resources. What is a Carbon Tax?Carbon Pricing reflects the environmental cost of the burned carbon. Carbon is the fundamental component of every substance on earth and it is most abundantly released in the atmosphere as CO2. The carbon tax was introduced as a fee that was imposed by the government on carbon emissions from fossil fuel combustion or any other energy-related emissions, proposed in The Energy Innovation and Carbon Dividend Act. It was introduced in the House on November 27, 2018, as H.R. 7173. The carbon tax is the prototypical example of a “Pigouvian tax”; a tax that businesses or individuals pay for the mitigation of all the externalities due to carbon emissions. Carbon tax internalizes the cost of environmental damage. It ensures that the full cost (including the external cost to the environment) is being paid by the responsible consumers and companies. Putting a price on emissions;

It is also applicable to carbon-intensive imported goods. Carbon tax generates the federal revenue that is rebated back to the taxpayers. Carbon Chemistry & Carbon TaxThe combustion of fossil fuels generates carbon that is oxidized into CO2. The carbon chemistry is simple. The amount of carbon dioxide released is equivalent to the carbon content of the fuel. Coal is the most carbon-intensive of all. For the same amount of energy, coal (Anthracite) releases about 230 million Btu's of carbon dioxide compared to 160 million Btu's of gasoline and 120 million Btu's of natural gas. Thus, a heavy tax is levied on gasoline as compared to natural gas. This increases the gasoline and subsequently the energy prices. According to the U.S Interagency Working Group on Social Costs of Carbon tax, a price of $40 per metric ton of carbon would result in 36 cent increase in gasoline price. That, in turn, increases the average price of a kilowatt-hour of electricity by 2 cents. About 64 governments around the world have developed a system for carbon pricing to meet the Paris Agreement goals. These initiatives are bound to cover 12GtCO2 (about 23%) of global GHG emissions. Among European Countries, Finland was the first to impose a carbon tax in 1990. It is currently charging $25 per ton of emissions. Sweden and Norway followed the trend in 1991. In Sweden, the carbon tax helped reduce emissions by 27% and increase the economy by 83%. Norway has the stringent/highest carbon tax in the world, $51 per ton of CO2 from gasoline. The carbon emissions of the United Kingdom have reached its lowest limits due to a carbon tax of 18 pounds per ton. Eleven states of the U.S that include New York, California, Delaware, Maine, Massachusetts, New Hampshire, Maryland, New Jersey, Rhode Island, Vermont, and Connecticut have capped their emissions through Cap and Trade programs as well.

|

|

|

(833) CMS-LINE

(833) 267-5463 PO Box 13477 Mill Creek, Wa, 98082 © Conservation Made Simple. All rights reserved.

501(c)(3) Non-Profit, Tax ID#: 82-1646340 Copyright © 2021 Conservation Made Simple |